Introduction to Business Expenses

Business expenses refer to the costs incurred in the process of running a business, specifically those necessary for earning revenue. These expenditures are essential for maintaining operations, enabling growth, and ensuring compliance with accounting standards. Understanding the nature and classification of business expenses is critical as they directly affect a company’s profitability and overall financial health.

Business expenses can be broadly categorized into different types. Operating expenses, often referred to as OPEX, include costs associated with day-to-day functioning, such as rent, utilities, and salaries. These regular outlays are necessary for the ongoing operation of the business. Another significant category is capital expenditures, or CAPEX, which pertains to investments in long-term assets like equipment or property. Unlike operating expenses, capital expenditures are typically amortized over their useful life, reflecting their lasting value to the organization.

In addition to these, businesses also incur specific types of expenses, such as administrative expenses, advertising costs, and cost of goods sold (COGS). Each category serves its own purpose in the broader financial landscape of the company. For instance, COGS is directly correlated to the revenue generated from sales and must be meticulously tracked to gauge profitability accurately.

The significance of business expenses lies not just in their quantifiable figures but also in their ability to provide insight into a company’s operational efficiency. Proper management of expenses can lead to improved financial performance, allowing businesses to allocate resources effectively and make informed strategic decisions. Therefore, a comprehensive understanding of business expenses is indispensable for entrepreneurs and financial managers alike.

Types of Business Expenses

Business expenses are classified into various categories, each serving a distinct purpose in the financial framework of an organization. The primary types of business expenses include fixed expenses, variable expenses, direct expenses, and indirect expenses. Understanding these categories is essential for effective budgeting and financial analysis.

Fixed expenses are those costs that do not fluctuate with the level of production or sales. These expenditures remain constant over time, regardless of the business’s operational activity. Examples of fixed expenses include rent or lease payments, salaries of permanent employees, and insurance premiums. Due to their predictable nature, fixed expenses play a crucial role in budgeting, allowing businesses to forecast cash flow with precision.

Variable expenses, in contrast, change in proportion to the business’s level of activity. These costs rise and fall with production or sales volume. Common examples include raw materials, sales commissions, and utility costs. Tracking variable expenses is essential for managing budgets effectively, as they directly impact profit margins, especially in industries where production fluctuates significantly.

Direct expenses are specifically attributable to a particular business segment or activity. These costs can be directly traced to the production of goods or services. Examples include the cost of raw materials used in manufacturing and labor costs associated with production. On the other hand, indirect expenses cannot be directly linked to any single product or service. They often include overhead costs, such as administrative salaries, utilities, and office supplies.

Each type of business expense has unique implications for financial reporting and decision-making. Understanding these distinctions allows businesses to develop a robust budgeting strategy, enhancing their ability to manage finances effectively and drive profitability.

Recognizing and Tracking Expenses

Recognizing and tracking business expenses is a crucial aspect of financial management that can significantly impact an organization’s profitability and cash flow. Understanding different expense categories, such as operational, fixed, and variable expenses, allows businesses to maintain a clear financial picture. Accurate tracking not only aids in budgeting but also enhances strategic planning, as it provides insights into spending habits and areas where cost reductions may be feasible.

To effectively record expenses, businesses can make use of various methods and tools tailored to their specific needs. One common method is accounting software, which can facilitate seamless integration with bank accounts, automatically capturing transactions and categorizing them accordingly. This method enhances accuracy and minimizes the risk of human error, allowing businesses to spend more time focusing on growth rather than on tedious financial entries.

Alternatively, many businesses might find spreadsheets to be an efficient solution for tracking expenses. With customizable templates and formulas, spreadsheets allow users to monitor their expenditures, generate reports, and analyze trends over time. This method is particularly beneficial for businesses that operate on a smaller scale or prefer a hands-on approach to their financial management.

Mobile applications also provide modern solutions for expense tracking that cater to the on-the-go nature of today’s business environments. Expense tracking apps enable users to capture receipts, categorize expenses, and generate real-time reports directly from their smartphones. This level of accessibility ensures that no expenditure is overlooked and helps maintain financial integrity.

In conclusion, businesses should prioritize recognizing and tracking their expenses. By utilizing a combination of accounting software, spreadsheets, and mobile applications, they can ensure accuracy and diligence in their financial management practices. Over time, these methods contribute to more informed decision-making and improved financial health.

Impact of Expenses on Cash Flow

The relationship between expenses and cash flow is a fundamental aspect of financial management within a business. Expenses represent the outflow of funds necessary to operate a company, while cash flow refers to the net amount of cash being transferred into and out of a business. A proper understanding of this dynamic is crucial for maintaining liquidity and ensuring that a business can meet its short-term and long-term obligations. High expenses can lead to cash flow challenges, making it difficult for businesses to maintain sufficient liquidity to cover operational costs and invest in growth initiatives.

Effective cash flow management involves closely monitoring expenses and their impact on overall financial health. Businesses must regularly assess their recurring and variable expenses to identify areas where cost reductions can be made. By minimizing unnecessary expenditures, a company can optimize its cash flow, ensuring that it has enough funds available to meet its operational needs. Strategies such as budgeting and forecasting play a significant role in predicting expenses and potential cash flow disruptions. This proactive approach helps businesses prepare for lean periods and avoid liquidity crises.

In addition to monitoring expenses, implementing cost-control measures can further enhance cash flow stability. Techniques such as renegotiating contracts with suppliers, optimizing inventory levels, and automating processes can lead to reduced costs without compromising quality. Moreover, maintaining an appropriate balance between expenditure and revenue generation is essential. Understanding the intricacies of how expenses affect cash flow enables business owners to make informed decisions that bolster their company’s financial viability. Ultimately, a strong grasp of expense management will aid in sustaining a healthy cash flow, which is vital for long-term success and operational resilience.

Budgeting for Business Expenses

Budgeting for business expenses is a critical process that enables organizations to plan their financial activities effectively. The first step in creating an expense budget is to identify all potential costs associated with business operations. This includes fixed costs, such as rent and utilities, as well as variable costs, like materials and labor. A comprehensive understanding of these expenses allows businesses to allocate resources where they are most needed.

Next, it is important to analyze historical financial data to gain insights into previous spending patterns. This analysis can reveal trends and help in making informed decisions regarding future expenses. Forecasting expenses based on this historical data provides a basis for creating the budget. Factors such as seasonality, market trends, and anticipated changes in operations should be considered during this phase to ensure the budget reflects realistic expectations.

Once a draft budget is established, the next step is to align it with the organization’s financial goals. Setting specific goals for revenue and profitability can help in determining how much can be spent without jeopardizing the overall financial health of the business. Techniques such as zero-based budgeting, where every expense must be justified for each new period, can also be employed to ensure that resources are allocated effectively.

To maintain financial control, it is crucial to monitor actual spending against the budget periodically. This allows businesses to identify variances and make necessary adjustments to remain on track. Utilizing budgeting software can streamline this process, providing real-time insights into current spending and potential adjustments. Ultimately, regular reviews and adjustments to the budget will help ensure that the organization can meet its financial obligations while maintaining stability and growth.

Tax Deductions and Business Expenses

Understanding the intricacies of tax deductions related to business expenses is crucial for any business owner aiming to minimize tax liabilities while remaining compliant with regulatory requirements. Business expenses, which refer to the costs incurred in the process of earning revenue, can often be deducted from taxable income, thereby reducing the overall tax burden.

Common deductible expenses include operational costs such as rent, utilities, salaries, office supplies, and travel expenses incurred for business purposes. Additionally, expenses related to marketing, professional services, and insurance can also qualify as deductions. It is important for businesses to differentiate between personal and business expenses, as only the latter can be deducted. Misclassification can lead to complications during tax filing and potential audits.

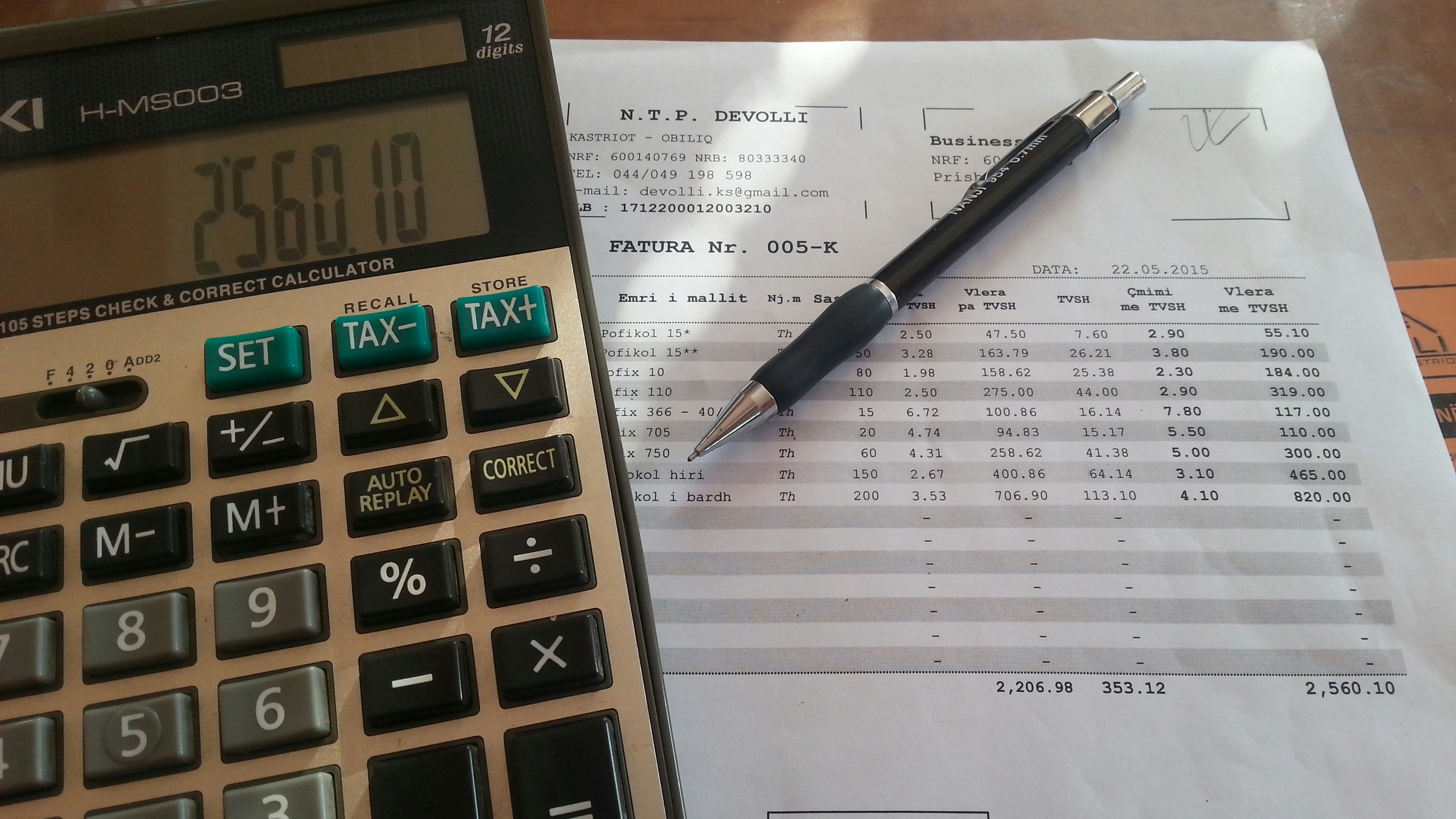

To ensure that all deductible expenses are recognized, maintaining meticulous records is imperative. This includes tracking receipts, invoices, and any documents that substantiate the expenditures. Using accounting software or a dedicated ledger can aid in organizing financial records efficiently. Such discipline not only simplifies tax preparation but also provides critical insights into the business’s financial health.

Moreover, there are best practices to maximize deductions effectively while adhering to tax laws. Businesses should remain informed about the latest tax regulations, as the rules surrounding deductions can change. Consulting a tax professional is advisable to navigate complexities, especially for unique deductions like home office expenses or depreciation of assets. Staying compliant and informed can empower business owners to leverage deductions fully, thus optimizing their tax strategies.

In conclusion, understanding and managing business expenses relative to tax deductions is essential for fostering financial success. By keeping records organized and being aware of what qualifies as a deductible expense, businesses can take full advantage of available tax benefits while staying compliant with regulations.

Managing and Reducing Expenses

Effectively managing and reducing business expenses is crucial for enhancing profitability and ensuring the long-term sustainability of any enterprise. A strategic approach can lead to substantial savings while maintaining the quality of products and services. The first step in this process is to conduct a thorough analysis of all expenditures. Identifying unnecessary spending is vital. Businesses can achieve this by reviewing expense reports, categorizing costs, and determining which expenditures directly contribute to revenue or operational efficiency.

Once unnecessary expenses are identified, organizations should implement cost control measures. This may involve negotiating better terms with suppliers, engaging in bulk purchasing for discounts, or exploring alternative suppliers who may offer better prices without compromising quality. Regularly evaluating vendor contracts can unveil potential savings and encourage more favorable terms that benefit the business’s bottom line.

In addition, businesses can optimize operational efficiency by adopting technology solutions that streamline processes and reduce labor costs. Investments in automation, for instance, can reduce manual errors and enhance productivity, ultimately leading to decreased operational expenses. Furthermore, implementing a culture of cost awareness among employees can foster an environment where all team members are vigilant in identifying potential savings, which can prove advantageous.

Making strategic decisions that contribute to cost savings may also involve reassessing company resources. For example, evaluating office space requirements can reveal opportunities for downsizing, especially in the era of remote work. Additionally, reviewing subscriptions and services that are infrequently used can lead to cancellations and further financial savings.

Ultimately, by continuously monitoring expenses and adapting to market changes, businesses can effectively manage their finances and reduce unnecessary costs, fostering an environment conducive to growth and profitability.

The Importance of Reviewing Expenses Regularly

Regularly reviewing business expenses is a critical practice that organizations should adopt to maintain financial health and operational efficiency. By systematically analyzing expenses, businesses can gain improved financial insight, assisting management in making informed decisions regarding budgeting and spending priorities. This process of periodic reviews enables companies to pinpoint trends in their spending, helping to identify patterns that may suggest either overspending in certain areas or opportunities for cost-saving measures.

A comprehensive expense review allows businesses to better understand where their money is going and how resources can be allocated more effectively. Financial trends can be identified through continuous monitoring, offering transparency into which areas of the business are consuming the most resources. Recognizing these patterns empowers businesses to adjust their budgeting strategies proactively, enabling them to invest in growth opportunities while minimizing unnecessary expenditures.

In addition to identifying overspending, regular expense reviews can uncover potential inefficiencies within operations. Companies might find that certain activities or services are not yielding satisfactory returns on investment. This can prompt organizations to reassess these operations, streamline processes, or even negotiate better terms with vendors—ultimately leading to enhanced profitability.

Furthermore, reviewing expenses regularly fosters a culture of financial accountability among staff members. Employees become more conscientious of their spending habits, as they understand the importance of aligning expenses with the organization’s financial goals. The discipline instilled through consistent reviews not only creates a more financially aware workforce but also encourages innovative strategies for cost reduction.

In essence, maintaining a routine of expense reviews is fundamental for businesses seeking to optimize their financial resources, drive sustainable growth, and enhance overall operational effectiveness.

Conclusion: The Role of Expenses in Business Success

In the realm of business, expenses play an integral role in determining overall financial health and sustainability. Effective management of business expenses directly influences profitability, cash flow, and, ultimately, the long-term success of an organization. As discussed throughout this guide, understanding the various categories of expenses—fixed, variable, and semi-variable—is essential for business owners aiming to optimize their financial strategies. Careful tracking and assessment of these expenditures enable businesses to make informed decisions that support growth and resilience.

Moreover, the implementation of effective budgeting practices fosters a disciplined approach toward managing financial resources. A well-structured budget not only helps in anticipating future expenditures but also serves as a critical tool for performance measurement. By regularly reviewing budget performance against actual results, business owners can identify variances and take corrective action to align spending with strategic goals.

In addition to budgeting, leveraging technology and accounting software can significantly enhance the visibility of business expenses. These tools can streamline financial processes, making it easier to track spending in real-time and generating reports that provide valuable insights into financial performance. With increased clarity on where resources are allocated, businesses can prioritize investments that yield the highest returns.

Ultimately, maintaining a proactive approach towards business expenses empowers owners to adapt to changing market conditions. By embracing sound financial management practices, businesses not only safeguard their assets but also position themselves to capitalize on new opportunities. As you review your own expense management strategies, consider implementing the concepts outlined in this guide to enhance your financial management practices, ensuring a more sustainable and successful business future.