Introduction to the Accounting Cycle

The accounting cycle is a fundamental process that encompasses a series of steps aimed at transforming raw financial data into coherent financial statements. This systematic approach is crucial for ensuring that businesses accurately capture, process, and report their financial activities, facilitating transparency and informed decision-making. The cycle begins with the initial recognition of transactions and culminates in the preparation of financial statements that summarize the company’s economic performance over a specific period.

At its core, the accounting cycle serves as a framework that guides accountants through various activities, including identifying transactions, recording them in journals, posting entries to ledgers, and ultimately generating financial reports. This structured methodology not only improves the accuracy of financial reporting but also enhances the reliability of the information presented to stakeholders, including investors, creditors, and regulatory authorities.

The significance of the accounting cycle cannot be overstated. It ensures that all financial transactions are accounted for in a timely and efficient manner, thereby mitigating the risk of errors and omissions that could lead to misrepresentation of an organization’s financial position. By adhering to the accounting cycle, businesses are equipped to produce various financial statements, such as the income statement, balance sheet, and cash flow statement, which are essential for evaluating financial performance and supporting strategic planning.

Moreover, the accounting cycle reinforces the principles of consistency and comparability in financial reporting, allowing organizations to compare their financial performance over different periods and against industry benchmarks. Understanding the accounting cycle is essential for anyone involved in the financial management or analysis of a business, as it provides the necessary tools to evaluate and interpret financial health accurately.

Transaction Occurs: Identifying Financial Transactions

Understanding financial transactions is fundamental to the accounting cycle. A financial transaction is defined as any event that involves the exchange of economic value, resulting in a measurable impact on an organization’s financial position. Such transactions can take various forms, including sales of goods or services, the acquisition of assets, incurrence of liabilities, and personal withdrawals by owners. These transactions must be quantifiable in financial terms to be recognized in the accounting records.

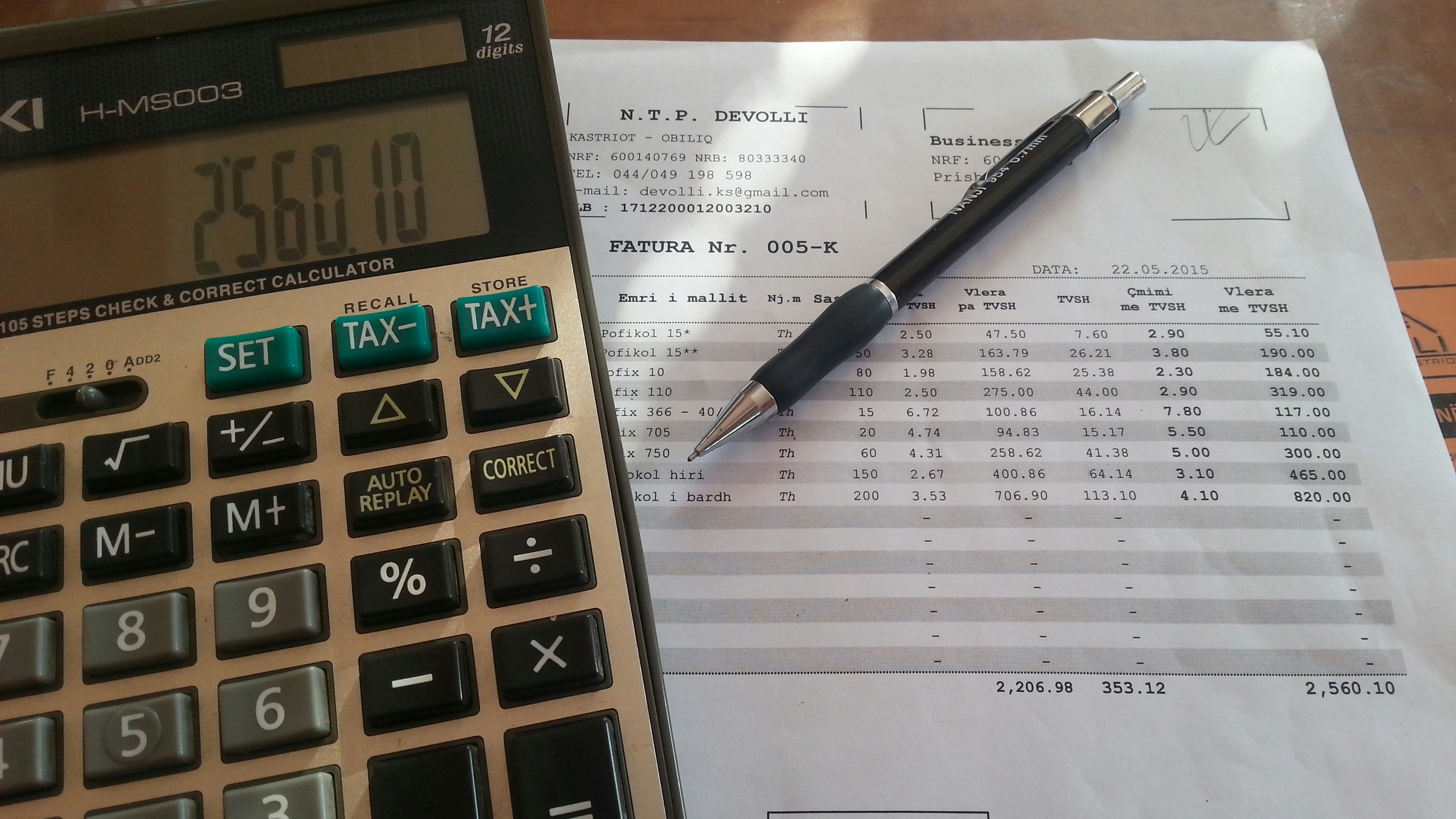

For a transaction to be considered valid within the accounting framework, it must meet certain criteria. Firstly, it must be verifiable, meaning there should be sufficient evidence to support its occurrence. This could be in the form of invoices, receipts, or contracts. Additionally, the transaction must have occurred during the designated accounting period, ensuring that the event is recorded in a timely manner. The transaction should also affect at least two accounts, adhering to the double-entry accounting system, which is foundational for accurate financial reporting.

Accurate documentation is critical for capturing all transactions correctly. It serves as a reference to ensure that each transaction’s details are clear and transparent. This documentation is crucial not only for internal audits but also for external stakeholders who may review financial statements. Moreover, a well-maintained record of transactions supports the preparation of financial statements, aiding in decision-making processes. Incorrect or incomplete documentation can lead to discrepancies, impacting the overall integrity of the financial statements and the accounting cycle. Thus, meticulous attention to detail when identifying and documenting financial transactions is essential in maintaining an accurate accounting system.

Journal Entry: Recording Transactions

The journal entry process is a fundamental component of the accounting cycle, serving as the initial step for recording financial transactions. Each transaction is systematically documented in a journal, which acts as a chronological log of all financial activities. The format of a journal entry typically includes the date of the transaction, the accounts involved, the amounts debited and credited, and a brief description of the transaction. This structured format ensures clarity and accuracy in financial reporting.

In a journal entry, the double-entry accounting system is applied, wherein every transaction affects at least two accounts. One account is debited while another is credited, maintaining the accounting equation’s balance. The debit indicates an increase in assets or expenses, or a decrease in liabilities or equity, whereas a credit signifies a decrease in assets or expenses, or an increase in liabilities or equity. It is essential to maintain the equality of debits and credits to ensure the integrity of financial records.

For example, if a company receives cash for services rendered, the journal entry would include a debit to the Cash account and a credit to the Service Revenue account. This entry reflects an increase in cash (asset) and an increase in revenue (equity). Conversely, if the company incurs an expense, such as utility bills, the entry would reflect a debit to the Utilities Expense account and a credit to Accounts Payable, indicating an increase in expenses and a liability owed.

The role of source documents is crucial in supporting journal entries. These documents, such as invoices, receipts, and contracts, serve as evidence for the transactions recorded. They provide the necessary details and verification needed to substantiate the entries, enhancing the reliability of financial data. Accurate and thorough documentation of journal entries, alongside corresponding source documents, is vital for ensuring robust financial reporting and compliance with accounting principles.

Posting to the Ledger: From Journal to Ledger

The ledger is an essential component of the accounting cycle, serving as the main repository for a company’s financial transactions. It acts as a master record that consolidates all entries from the journal, providing a structured overview that facilitates the creation of financial statements. Transferring data from the journal to the ledger, known as posting, is a critical step in maintaining accurate financial records, and it allows businesses to track their financial activities in an organized manner.

There are two primary types of ledgers: the general ledger and subsidiary ledgers. The general ledger is a comprehensive collection of accounts that summarizes all transactions of a business. It contains various accounts such as assets, liabilities, equity, revenues, and expenses. Subsidiary ledgers, on the other hand, provide detailed records for specific accounts, such as accounts receivable or accounts payable, and support the general ledger by providing additional granularity. Together, they offer a complete picture of a company’s financial status.

Maintaining accuracy during the posting process is vital. Each journal entry must be carefully transferred to its corresponding ledger account to ensure the integrity of financial information. Discrepancies or errors in this stage can lead to misleading financial statements, affecting decision-making and potentially causing regulatory or compliance issues. Thus, double-checking figures and cross-referencing entries can help prevent inaccuracies and preserve the reliability of financial data.

Errors in posting can have significant implications, as they not only complicate the financial reporting process but can also lead to a breakdown in the entire accounting cycle. Companies may find themselves investing more time and resources in corrective actions, resulting in inefficiencies. Therefore, meticulous attention to detail during the posting phase is paramount to upholding the accuracy and transparency of financial records.

Trial Balance: Ensuring Accuracy

The trial balance is a crucial component of the accounting cycle, serving as a tool to verify that the debits and credits recorded in the general ledger are in balance. After all transactions have been posted, the trial balance is prepared to ensure that the sum of debits equals the sum of credits. This step is essential for maintaining the integrity of financial records, as any discrepancies can indicate errors that must be corrected before moving on to the preparation of financial statements.

To prepare a trial balance, accountants list all account balances from the general ledger at a specific point in time. This list includes both asset and liability accounts, along with equity, revenue, and expense accounts. The debits and credits are then summed separately, allowing for an easy comparison. If the totals match, it indicates that the ledger entries are mathematically accurate. However, if there is a discrepancy, a thorough review is required to identify and rectify errors, such as incorrect postings or miscalculations.

The importance of the trial balance extends beyond merely verifying mathematical accuracy. It serves as an initial checkpoint before the preparation of key financial statements, such as the balance sheet and income statement. By ensuring that the accounts are accurate, the trial balance provides a reliable foundation for these statements, which stakeholders rely on for informed decision-making. Thus, the trial balance not only helps identify errors but also enhances the overall reliability of the financial reporting process.

Overall, the trial balance is a vital tool in the accounting process that facilitates accuracy and clarity. By effectively capturing the state of accounts after all transactions have been recorded, it ensures that financial statements derived from it reflect a true and fair view of an organization’s financial position.

Adjusting Entries: Preparing Financial Statements

Adjusting entries play a pivotal role in the accounting cycle, ensuring that financial statements accurately reflect a business’s true financial position. These entries are typically made at the end of an accounting period before the preparation of financial statements. The goal is to recognize revenues and expenses in the appropriate period, adhering to the accrual basis of accounting, which dictates that transactions are recorded when they occur, not when cash changes hands. This principle underscores the importance of making necessary adjustments through accruals and deferrals.

Accruals refer to entries that recognize revenues and expenses that have occurred but have not yet been recorded in the accounting system. For example, if a company has performed a service in December but will not receive payment until January, an adjusting entry is made to recognize the revenue in December. Similarly, if an expense is incurred in December but will not be paid until January, an adjusting entry ensures that the expense is recorded in the correct month, portraying an accurate picture of the company’s profitability for the period.

On the other hand, deferrals are adjustments made for payments made in advance and their subsequent recognition as expenses or revenues. A classic example of this is prepaid expenses, such as insurance premiums paid for coverage over several months. An adjusting entry will allocate the appropriate portion of the expense to the period it pertains to as time passes, ensuring that the financial statements reflect only the expenses incurred during the reporting period. This practice not only assists in representing accurate financial information but also enhances the reliability of financial statements.

By employing adjusting entries effectively, businesses can maintain the integrity of their financial reports, providing stakeholders with a clearer understanding of financial health and performance. Properly executed adjustments contribute significantly to the accuracy of income statements and balance sheets, which are essential components for informed decision-making.

Financial Statements: The End Product of the Accounting Cycle

At the conclusion of the accounting cycle, three primary financial statements are produced: the income statement, balance sheet, and cash flow statement. Each of these reports plays a critical role in providing a comprehensive overview of a company’s financial health, and they serve different purposes for stakeholders, including investors, creditors, and management.

The income statement lists a company’s revenues and expenses over a specific period, culminating in the net income or loss for that period. This statement is integral as it evaluates the company’s operational performance. Investors analyze this document to determine profitability trends and to gauge the effectiveness of management in utilizing resources. Notably, the income statement can also highlight areas of over-expenditure or unsustainable revenue streams, prompting deeper analysis.

Next is the balance sheet, which reflects a company’s financial position at a specific point in time. It comprises three primary components: assets, liabilities, and equity. This statement provides insight into the company’s capital structure and its capacity to meet short-term and long-term financial obligations. Stakeholders often utilize the balance sheet for ratio analysis, which enables them to compare financial standing with industry benchmarks and assess leverage and solvency ratios.

Finally, the cash flow statement details the inflows and outflows of cash within the organization during a given period. This statement categorizes cash flows into operating, investing, and financing activities, offering a clear picture of how a company generates cash and manages liquidity. A thorough review of this statement can indicate the organization’s ability to sustain operations, invest for growth, and distribute dividends to shareholders.

These financial statements collectively encapsulate the results of the accounting cycle, guiding decision-making processes for various stakeholders and laying the groundwork for future business strategies.

Closing the Books: Finalizing the Accounts

Closing the books is a critical step in the accounting cycle, which marks the transition from one accounting period to the next. This process involves finalizing all financial transactions for the period and preparing for the upcoming cycle. The primary objective of closing the books is to ensure that temporary accounts reflect zero balances at the start of the new period, providing a clear and accurate financial picture.

Temporary accounts, which include revenues, expenses, and dividends, need to be closed at the end of each accounting period. This is done by transferring their balances to permanent accounts, typically within the equity section of the balance sheet. The common method for closing these accounts is through a series of journal entries that debit revenue accounts and credit expense accounts, subsequently impacting the retained earnings account. This transfer process helps maintain accurate tracking of financial performance over time.

Accuracy during the closing process is paramount, as any errors could lead to misstatements in the financial statements. To prevent inaccuracies, accountants often take several precautionary steps. These may include performing account reconciliations, ensuring all transactions are recorded, and verifying that all financial information aligns with the general ledger. Completing these tasks allows for a smooth transition into the new accounting period and sets a strong foundation for future financial reporting.

Moreover, timely and efficient closing of the books enables organizations to generate essential financial statements, such as income statements and balance sheets, promptly. These statements are crucial for managerial decision-making and external reporting. Consequently, understanding the significance of this process is vital for businesses aiming to maintain financial integrity and facilitate informed strategic planning.

Conclusion: Recap of the Accounting Cycle

The accounting cycle is a systematic process that provides a framework for businesses to track their financial transactions and ensure accurate financial reporting. This cycle consists of several integral components: identification and analysis of transactions, recording in journals, posting to ledgers, preparing trial balances, making adjustments, and ultimately creating financial statements. Each of these steps plays a crucial role in maintaining the integrity of financial data.

Beginning with the identification and analysis of transactions, businesses must ensure that all economic activities that impact financial position are accurately recorded. This foundational step is critical as it sets the stage for subsequent phases. Recording these transactions in journals allows for a chronological tracking of all business activities, while posting them to ledgers organizes this data by account, facilitating easier analysis and interpretation.

Preparing trial balances serves as a checkpoint in the accounting process, ensuring that debits and credits match before adjustments are made. This step is significant as it confirms the mathematical accuracy of the recorded transactions. After making any necessary adjustments, the preparation of financial statements presents a comprehensive picture of the business’s financial health, reflecting its operations over a specific period.

In conclusion, the accounting cycle is essential not only for producing accurate financial reports but also for aiding stakeholders in their decision-making processes. It ensures compliance with accounting standards and helps businesses operate effectively and transparently. By understanding each step of the accounting cycle, businesses can improve their financial reporting, enhancing credibility and trust among investors, creditors, and regulatory bodies alike.