What are Accrued Expenses?

Accrued expenses refer to the liabilities that a company incurs for goods and services that have been received or utilized but have not yet been billed by the supplier. This accounting practice is fundamental in adhering to the accrual basis of accounting, where expenses are recognized when incurred, irrespective of the timing of cash flows. By acknowledging accrued expenses, businesses ensure that their financial statements reflect a more accurate picture of their financial position and performance during a given accounting period.

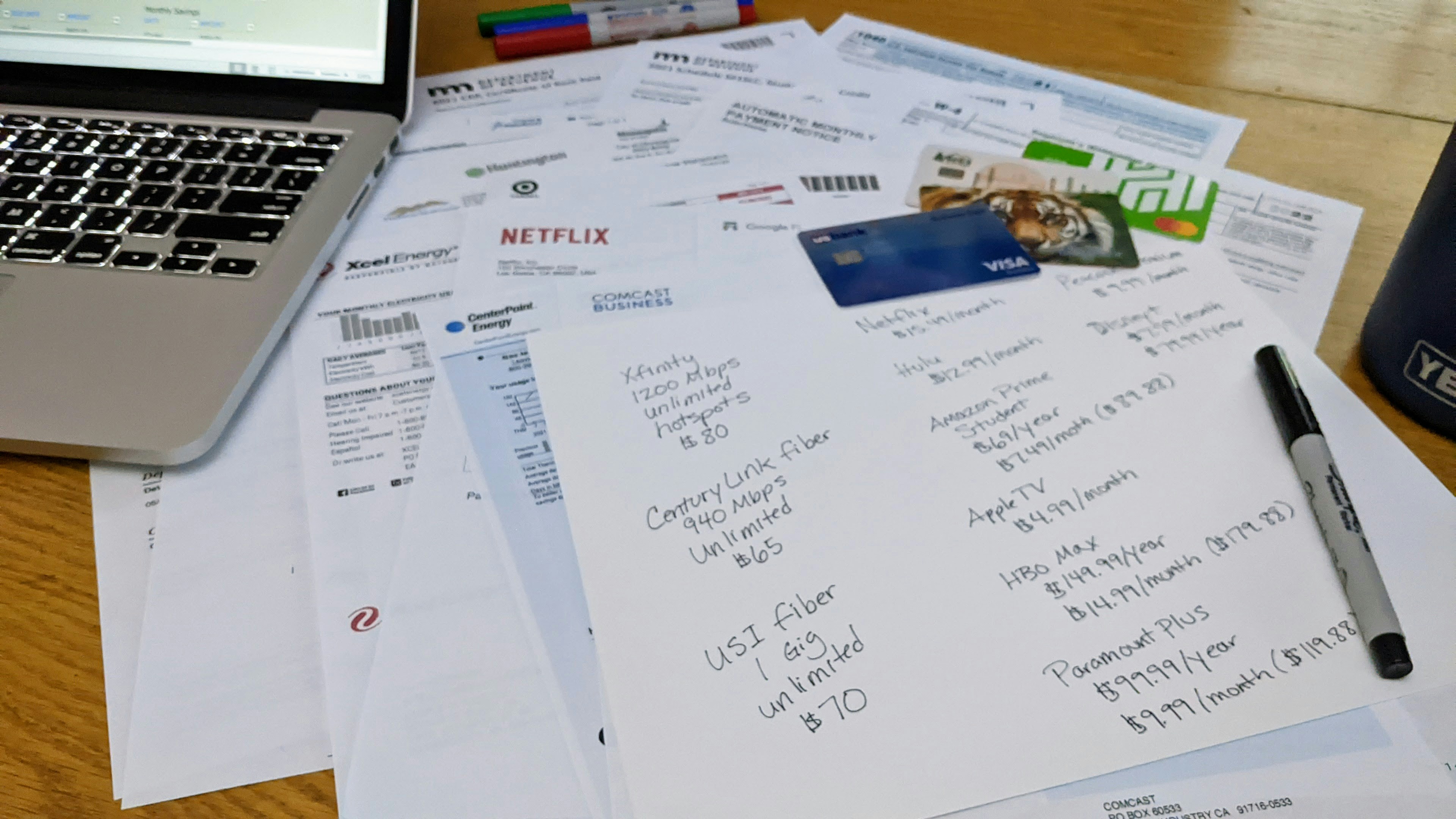

In essence, accrued expenses are recorded in the books before any formal invoicing occurs. For example, a company might receive electricity or utility services at the end of the month and will record the expense related to the usage immediately, even though the invoice from the utility company may arrive in the subsequent month. This allows businesses to present the real cost of operations in their financial records, aligning expenses with the revenues they generate in the same reporting period.

The significance of accrued expenses lies in their role in financial reporting. They help maintain the integrity of financial statements by ensuring that liabilities are recognized in accordance with the relevant accounting principles. This not only facilitates better decision-making by management but also enhances transparency for stakeholders such as investors, creditors, and regulatory authorities. Furthermore, by recognizing these expenses, a company can manage its cash flows more effectively and plan for future financial obligations.

Overall, understanding accrued expenses is crucial for businesses aiming to maintain accurate financial records. It is an essential component of the broader accounting framework that contributes to sound financial management and compliance with accounting standards.

The Importance of Accrued Expenses in Financial Reporting

Accrued expenses play a crucial role in financial reporting, serving as a cornerstone in the accurate depiction of a company’s financial health. These expenses are obligations that a company incurs during a specific accounting period but has not yet paid. Recognizing such expenses in the period they are incurred, regardless of when cash payment occurs, is essential for presenting a true and fair view of the company’s financial position. This practice aligns with the accrual basis of accounting, which dictates that revenues and expenses should be recorded when they are earned or incurred, rather than when cash changes hands.

By incorporating accrued expenses into financial statements, organizations can provide stakeholders with a more realistic understanding of their financial performance. This adherence to the accrual basis of accounting ensures that all expenses related to the reporting period are duly recognized. Consequently, this enables a more accurate matching of revenues and expenses, which is fundamental for effective financial analysis and decision-making. Investors, creditors, and management rely on this information to assess the true profitability and liquidity of a business.

Moreover, failing to account for accrued expenses can lead to significant misstatements in a company’s financial reports. Such inaccuracies might mislead stakeholders, resulting in poor investment decisions and a distorted view of a company’s operational efficiency. As such, recognizing accrued liabilities ensures that the financial statements reflect not only the fiscal responsibilities of a corporation but also its adherence to generally accepted accounting principles (GAAP).

In summary, accrued expenses are integral to financial reporting, reinforcing the necessity for companies to maintain transparency and accuracy. By reflecting the liabilities incurred during a specific period, organizations can better convey their financial position, thereby fostering trust and informed decision-making among investors and stakeholders alike.

Common Types of Accrued Expenses

Accrued expenses play a vital role in the financial management of a business, representing costs incurred but not yet paid. Understanding the common types of accrued expenses helps businesses accurately reflect their financial obligations. Below are some prevalent examples:

Wages Payable: Wages payable is one of the most common forms of accrued expenses. This occurs when employees have worked a certain number of hours, but the payroll has not yet been processed. Employers typically record this liability at the end of each accounting period to ensure that the expenses reflect the labor costs incurred. This situation often arises in businesses with bi-weekly or monthly payroll schedules.

Interest Payable: Another frequent accrued expense is interest payable. This situation arises when a business has borrowed money and must recognize the interest cost that has accrued up to the reporting date. Interest is often payable at specific intervals, but financial statements must account for this accumulated cost to provide an accurate picture of a company’s liabilities. Businesses must track interest accruals to manage cash flow effectively.

Utilities Payable: Utilities such as electricity, gas, and water are essential services for most businesses. However, utility bills may not always align with the company’s billing cycles, leading to accrued utility expenses. For instance, a business may receive a bill for services rendered in the previous month, which needs to be recorded as a liability to match the incurred expense.

Taxes Payable: Tax obligations constitute another significant category of accrued expenses. Companies must estimate their tax liabilities for the period and record these amounts as taxes payable within the financial statements. This ensures that businesses abide by compliance regulations and maintain an accurate reflection of their financial health.

Each of these accrued expenses is crucial in understanding how operational activities influence a company’s financial position and cash flow planning.

How to Calculate Accrued Expenses

Calculating accrued expenses is an essential task for businesses aiming to maintain accurate financial records. This process involves estimating the costs that have been incurred but not yet paid by the end of the accounting period.

The first step in calculating accrued expenses is to identify the expenses that need to be accrued. Common examples include salaries, utilities, and interest on loans. Once these expenses have been identified, businesses should estimate the total amount due. This estimation can often be based on previous periods’ data, providing a reliable foundation for the calculations. For example, if a utility bill averaged $1,000 in previous months, this figure can serve as an estimate for the current month.

Next, businesses must consider the timing of the expenses. In cases where the billing cycle differs, adjustments may be necessary. For instance, if an expense incurred in December is not billed until January, it should still be counted in the December accrued expenses to comply with the matching principle in accounting.

Additionally, it is essential to take into account any contract terms or agreements that might affect expense amounts. Contracts may specify certain fees or adjustments; thus, reviewing them can provide more accurate estimates. Another factor to consider is variations in business operations, which may impact expense patterns. For example, if a company is expanding, one might expect increased utility costs.

To enhance accuracy in estimating accrued expenses, regular reviews of calculations and comparisons with actual expenses paid in prior periods can be beneficial. Moreover, maintaining clear documentation of assumptions used in estimates will help justify them during financial reviews or audits. Following these structured steps will enable businesses to calculate accrued expenses correctly, thus ensuring financial accuracy and compliance.

Recording Accrued Expenses in Accounting Records

Accrued expenses are an important aspect of financial accounting, as they ensure that expenses are recorded in the period they are incurred, even if they have not been paid yet. The proper recording of accrued expenses requires careful attention to accounting entries to reflect the company’s financial position accurately. An accrued expense is recorded through a journal entry that typically includes a debit to the relevant expense account and a credit to an accrued liabilities account.

When an expense is accrued, the initial journal entry debits the expense account, which increases the total expenses reported for that accounting period. Concurrently, the credit entry is made to the accrued liabilities account, representing a liability that the company owes. For instance, if a company incurs $1,000 in utilities expense that has not yet been paid by the end of the accounting period, the journal entry would consist of a debit of $1,000 to the utilities expense account and a corresponding credit of $1,000 to the accrued liabilities account. This entry recognizes the value of the expense while acknowledging the obligation to pay it in the future.

Upon receipt of the actual invoice for the accrued expense, it is critical to reverse the original journal entry to prevent double-counting of expenses. The reversing entry typically involves debiting the accrued liabilities account and crediting the cash or accounts payable account, depending on how the company chooses to settle the liability. For example, once the utilities invoice is received and paid, a journal entry would involve debiting the accrued liabilities account and crediting the cash account to reflect the payment. Keeping accurate records of accrued expenses and their reversals is essential for maintaining the integrity of financial reporting and ensuring compliance with accounting standards.

Impact of Accrued Expenses on Cash Flow

Accrued expenses, a critical component of the accrual accounting method, significantly influence a business’s cash flow statements. Unlike cash basis accounting, where revenues and expenses are recorded only when cash is exchanged, accrual accounting recognizes expenses when they are incurred, regardless of when the actual cash payment occurs. This distinction is essential for understanding the implications accrued expenses have on an organization’s financial health.

When accrued expenses are recognized, they do not immediately impact cash flow. For instance, if a company incurs utility expenses for the month of September but pays for them in October, the expense recognizes that liability during September’s accounting period. Consequently, while it affects the net income for that period, the actual cash outflow will occur later, in the following month. This timing mismatch often creates a discrepancy between reported profitability and actual cash flow, which can lead to challenges in cash flow management and forecasting.

Moreover, businesses must account for accrued expenses when analyzing cash flow projections. Understanding the timing and amount of these expenses helps companies mitigate the risk of cash shortages. It becomes evident that although accrued expenses do not trigger immediate cash outflows, they play a crucial role in depicting the true economic picture of the organization. By considering accrued expenses, management can implement effective cash flow strategies, ensuring they remain solvent and able to meet upcoming obligations.

In light of these intricacies, businesses need to maintain a comprehensive approach to financial planning. This includes regularly monitoring accrued expenses to assess their impact on cash flow. Employing proper accounting practices allows organizations to enhance their cash flow forecasting, thereby ensuring better preparedness for both anticipated and unforeseen expenses.

Challenges and Mistakes in Managing Accrued Expenses

Managing accrued expenses can be a complex task for businesses, and various challenges may arise during the process. One of the most common issues is inaccurate estimations. Businesses often rely on past trends to project future expenses, which can lead to incorrect figures if significant changes occur in operations or market conditions. For instance, fluctuations in service rates or product prices may not be accounted for, resulting in either overestimating or underestimating accrued expenses. Such inaccuracies can affect cash flow predictions and overall financial accuracy.

Another prevalent mistake is the failure to reverse accruals timely. Accrued expenses, once recorded, must be adjusted or reversed once the actual expenses are incurred. If a business neglects to remove these accruals from its financial statements, it risks inflating expenses and distorting net income for the reporting period. This misrepresentation can mislead stakeholders about the company’s financial health and viability.

Furthermore, misclassification of expenses poses another challenge. Accrued expenses must be accurately classified in accordance with accounting principles and guidelines. If recruiters mistakenly categorize operational costs as accrued expenses, it can misrepresent an organization’s financial standing. Therefore, ensuring that all classifications align with the financial reporting standards is crucial for maintaining clarity and compliance.

To mitigate these issues, businesses should adopt best practices in budgeting, forecasting, and internal processes. Regular training and updates for financial teams on the latest accounting standards can prevent misclassifications. Moreover, conducting periodic reviews of accrued expenses allows for timely adjustments and better accuracy. By addressing these common challenges and mistakes, organizations can enhance their financial reporting quality and better manage their accrued expenses.

Annual and Periodic Adjustments for Accrued Expenses

Accrued expenses represent costs that have been incurred by a company but have not yet been paid or recorded in the company’s financial statements. Proper management of these expenses is critical for maintaining accurate financial records. At the end of each accounting period, businesses are required to conduct a thorough review of their accrued expenses to ensure that their financial statements present a true reflection of their liabilities.

Annual and periodic adjustments to accrued expenses serve several purposes. Primarily, these adjustments help in aligning the company’s financial records with the actual financial position. For example, if services have been received but no payments have been made by the end of the accounting period, an accrual adjustment will need to be made to capture these expenses accurately. This alignment is essential for stakeholders who rely on financial statements to make informed decisions.

Adjustments can involve estimating the accrued amount based on historical data or contractual agreements. Companies typically look at recurring liabilities such as wages payable, utilities, or interest expense that may not be due until a later date but were consumed during the reporting period. By recording these amounts, the organization provides a clearer picture of its financial obligations and avoids inflating its net income.

Moreover, the implications of accurately adjusting these expenses extend to year-end financial statements. Inaccurate accounting for accrued expenses may lead to unwarranted financial results, ultimately affecting the company’s credibility with investors, creditors, and regulatory bodies. Therefore, regularly reviewing and adjusting accrued expenses is not merely an accounting formality but a critical practice that helps maintain financial integrity and transparency.

Conclusion

Accrued expenses play a pivotal role in the realm of financial management, bridging the gap between accounting principles and real-world business operations. They represent those liabilities that have been incurred but not yet paid, reflecting a true and fair view of a company’s financial position. By acknowledging these expenses in the accounting period in which they occur, businesses ensure compliance with the accrual basis of accounting, which enhances the accuracy of their financial statements.

The accurate reporting of accrued expenses is crucial, as it helps organizations to avoid the pitfalls of misrepresenting their financial health. This practice allows for a more precise assessment of profitability and cash flow, which is essential for effective budgeting and forecasting. Furthermore, timely recognition of accrued expenses can lead to better decision-making, ensuring that resources are allocated efficiently and potential liabilities are managed judiciously.

While navigating the complexities of accrued expenses may seem daunting, implementing best practices can greatly simplify the process. It is advisable for organizations to establish robust internal controls and regular review processes to track accrued expenses accurately. Consistent documentation and communication with relevant stakeholders can also enhance visibility and understanding of these liabilities, fostering a culture of transparency within the organization.

Ultimately, the effective management of accrued expenses not only aids in achieving compliance with accounting standards but also supports strategic decision-making. By recognizing the implications of these expenses, organizations can bolster their financial integrity and position themselves for long-term success. Embracing the importance of accrued expenses within financial management practices will enable businesses to operate more effectively and maintain a competitive edge in the market.